Introduction

Global retail has never been so intense, disruptive and thrilling.

The aftershocks of the pandemic, global economic uncertainty, shifting consumer needs, and technological disruptions are forces that keep retail CEOs up at night.

As retailers around the world try to untangle and navigate complex industry trends, they’re carefully examining trends to enhance competitiveness, improve the in-store experience for their shoppers, and drive profitable growth.

Among these trends are the rise of retail media, the application of artificial intelligence (A.I.), and a focus on experiential retail.

This paper will dive deeper into these top retail trends and more so you can be prepared for what lies ahead. We’ll share what agile global retailers are already doing to manage and de-risk market factors and offer timely solutions to make your business more productive and profitable in 2024 and beyond

1. Retail Media in stores will fuel revenue growth

As consumer spending slows, more retailers are turning their attention to brand advertisers, especially consumer packaged goods (CPG) companies, to grow the top line with retail media.

Global retail media advertising revenues are expected to reach $125.7 billion in 2023. They’re growing so fast that they’re on track to surpass television ad revenue by 2028.1

Retail media is poised for explosive growth because it helps global retailers –including Amazon, Walmart, Kroger, Tesco, and Mercado Libre – earn new incremental revenue.2 Retailers sell advertising to brands along the omnichannel customer journey so brands can reach and influence customers in the moment as they shop.

What makes stores so magnetic for retail media?

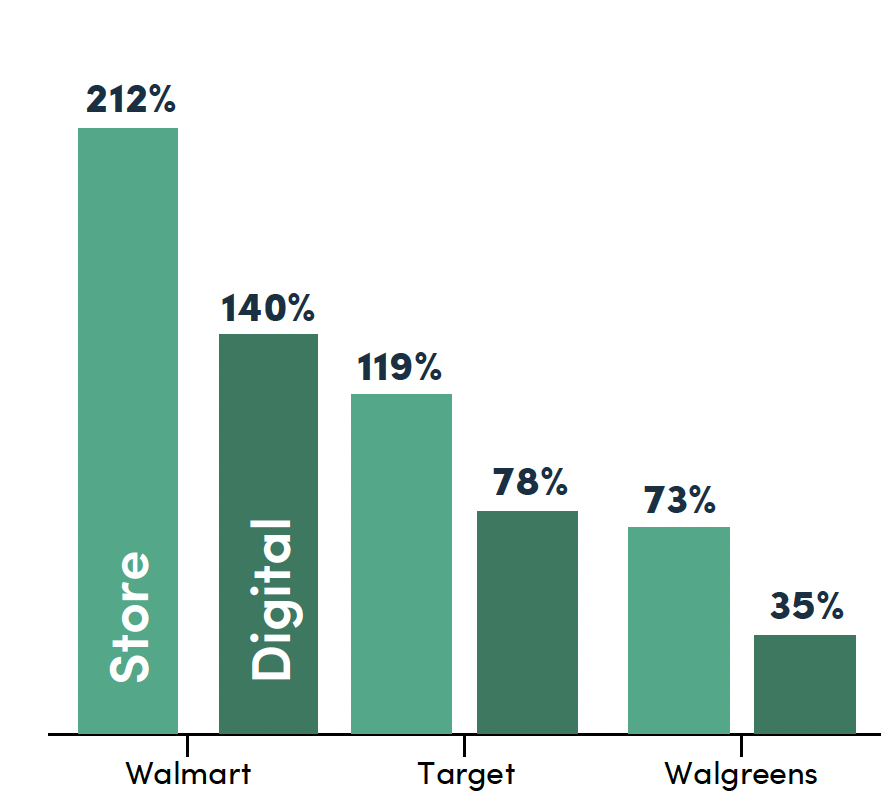

Today, over 85% of all U.S. retail sales take place in physical stores.3 This means that retailers looking to earn additional revenue from their brick-and-mortar locations will quickly realize the incremental revenue opportunities that a retail media program can represent. Among leading U.S. retailers, the average size of in-store audiences was 70% higher than digital audiences.4

For instance, a study found that in November 2022:

- Walmart‘s average number of unique in-store visitors was 212 million vs 140 million digital vistors

- Target attracted 119 million in-store shippers vs. 78 million digital shoppers.

- Walgreen had 73 million in-store shoppers vs 35 million shoppers.5

Due to comparatively higher traffic in stores, more retailers will focus on selling in-store retail media ad opportunities like store shelves, end caps, cooler doors, and checkout aisles.6

To monetize these physical assets with high-margin B2B ad sales, retailers are turning to a range of technologies, including adtech solutions and store management tools.

Savy retail leaders innovate with in-store ad opportunities

Global grocery leaders in particular are already focusing on targeted, in-store advertising to improve product discovery and conversions.

Walmart is investing more in retail media like in-store audio and free food samples to make brick-and mortar stores more enjoyable for

customers and more appealing to brand advertisers.7, 8

Its grocery rival, Kroger, is adding digital smart screens to 500 stores across the U.S. to engage shoppers with relevant promotions and product information.9

Digital screens are in-demand across the Atlantic, too. U.K. supermarket chain Sainsbury’s plans to more than double the number of digital screens in its stores, from 320 to more than 800 to bring ads closer to the point of sale.10

In-store visitors outnumber digital visitors across leading retailers

Stores use retail intelligence for retail media compliance and excellence

We believe more retailers will deploy and leverage retail intelligence

platforms to better understand the performance of their in-store media activations by promotion, fixture, and location.

These systems can be used not only to track compliance of the media being shown within each location with what was planned based on advertisers’ media booking agreements (by campaign, region, and territory), but also to evaluate the performance of the ads being shown based on in-store sales generated.

Retailers that leverage these insights to ensure the media plan is properly executed, promptly manage issues when they arise, and refine plans to optimize sales are best positioned to win.

Another benefit of retail intelligence platforms is that busy, multi-store retail chains save a significant amount of time when the head

office can immediately see inside every store location to ensure plans

are being executed properly.

Optimum Retailing (OR) works with retailers to provide dynamic planograms for each store location, which retailers can then use to identify what media assets can be displayed on what screens in which locations of their stores.

OR’s advanced system can also enable the rapid distribution of the exact equipment, instructions, and plans needed at each location to support retail media excellence in stores.

2. Retailers will urgently seek new efficiencies as

inflation makes consumers more discerning

Retailers are facing margin compression like never before as increasingly budget-conscious consumers

look for deals to stretch their dollars further. To remain profitable, retailers will need to find in-store

efficiencies that maintain retail margins without detracting from in-store shopping experiences.

Amid inflation higher than we’ve seen in decades, consumers are more hesitant to spend, a trend that directly impacts retail

growth.

A recent survey found 92% of middleincome Americans feel worried about higher prices and have hit the brakes on spending.11

Many consumers now buy less, wait for deals, and switch to more affordable products, including private labels.12, 13

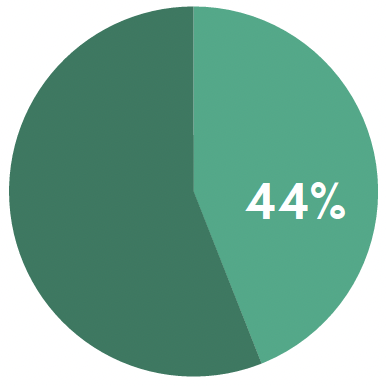

The high cost of living led 44% of global consumers to save more money in 2023.

However, consumers remain willing to spend on things they really want – and they increasingly hunt for the best deals.14

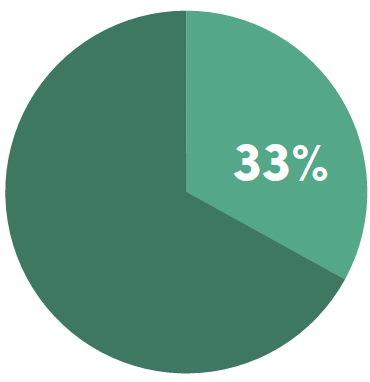

44% of global consumers saved more money in 2023

Inflation puts pressure on retailers, too

Most retailers genuinely want to satisfy

consumers’ evolving needs by promoting

great deals, but inflation is also

squeezing retailers’ margins.

According to a recent survey, only one third

of retail executives felt very confident about maintaining or improving profit margins due to these

challenging market conditions. Six in 10 respondents expect inflation to raise operating costs, yet they want to avoid passing higher prices on to consumers.15

Within this economic context, more retailers are taking action to find new efficiencies to protect their margins so they can afford to fund the deals that consumers demand.

Retailers cut back on expenditures to protect margins

International retailers are actively seeking ways to reduce mounting expenses.

U.S. retail pharmacy giant Walgreens is going “line by line” to identify where it could cut costs. Walgreens is scrutinizing each of its initiatives to reduce expenses, focus on priority projects, and reduce the number of

tasks required from store level staff.16 As a result of this analysis, Walgreens plans to exit five underperforming

markets.17

To help retailers achieve their operational efficiency targets, consulting firm KPMG offers a general guideline: grocers should plan to reduce their cost base by 5-12% compared to pre-covid cost structures and for non-food retailers the range is 5-25%.19

The firm recommends retailers reduce costs by redesigning existing operations to eliminate non-value add activities (such as manually counting inventory and inspecting shipments) within replenishment, cross-channel processes, and data analysis.

Retailers will align with consumers’ shopping lists (in any economy)

Since consumers will continue to seek good value for their money in 2024, retailers need to consider: What will they buy?

Digitized planograms can help retailers be more nimble when it comes to their product assortments, strategically promoting deals and bestsellers to earn consumers’ business even in an uncertain

economy.

We’re also seeing more retailers use Flexible Planograms to feature popular and trending products. By allocating space in their stores for items that may

only be available for short periods of time, retailers can quickly adapt their merchandise, and any accompanying

marketing material to promote these hot items, improving retail sales performance.

Retailers using an effective retail intelligence platform can access these digital planograms in one place, giving store teams a single source of information to share details of every planogram variation.

This enables both greater compliance for head-office-driven planograms and better system-widen learning for locally-developed planograms that prove especially effective in driving incremental sales.

3. A.I. will force retailers to evolve

While artificial intelligence (A.I.) had a landmark year in 2023, its adoption in retail will begin to rapidly accelerate in 2024.

Experts predict A.I. services in the global retail sector will jump from $5 billion in 2022 to more than $31 billion by 2028.20

The technology’s benefits are so compelling for retail applications, we expect soaring demand for A.I. in retail will quickly separate progressive retailers from inert rivals.

A.I. is growing in strategic significance in retail

Rapid market changes and evolving consumer needs continue to test retail teams’ resilience, and A.I. users gain a competitive advantage with faster processes and actionable insights.

Among the most celebrated benefits of applying this technology to retail processes is that A.I. helps retailers replace guesswork with data-driven certainty. Retail teams using A.I. can evolve with speed and agility to keep up with shifting consumer needs and market factors and gain an edge.

Conversely, a lack of agility raises retail risk by being too slow and inflexible. Retailers that struggle to pivot quickly risk losing sales, stores, and perhaps even their chance of survival.

At least 20 major retailers, including Gap, Party City, and Bed Bath & Beyond, announced U.S. store closures in 2023, representing a stunning 2,847 locations.22

Clearly, maintaining the status quo is no longer an option to stay relevant and competitive in retail.

Retail leaders embrace A.I. to improve the customer experience

The use of A.I. benefits retailers, consumers, and employees across retail categories.

French beauty giant Sephora uses A.I. to enhance customer experiences by catering to global consumers’ range of ethnicities, complexions, and skincare needs. The retailer analyzes massive amounts of customer data to better understand individual preferences and

optimize product fit. This data-driven approach allows Sephora to personalize product recommendations, enhancing customer satisfaction and loyalty.23

”A.I. will help retailers

accelerate operational

processes, and make

data-driven decisions

that improve

performance,

profitability, and the

customer experience.”

– Sam Vise, CEO and Co-Founder,

Optimum Retailing

For a smoother and more pleasant grocery experience, Kroger has adopted A.I. to reduce its self checkout

errors, deploying the technology across 2,500 stores. A.I. helps Kroger speed up the overall self-checkout process and save shoppers time, which enhances the

in-store experience.

To reduce friction for omnichannel shoppers, Spain’s fast fashion leader Zara introduced A.I.-driven robots designed to serve customers who use buy online, pick-up in store (BOPIS). The robots retrieve products from the back of the automated retail stores to prevent long lines and reduce customers’ waiting times.25

According to Vogue Business, a growing number of fashion retailers are using generative A.I. to help store employees improve time savings and access up-to date information for better decision making – benefiting consumers and

retailers alike.26

A.I. supports retailers’ need for speed

A.I. can transform mountains of data into actionable insights and accelerate

operational processes to help retailers meet consumer expectations.

That’s why more retailers will rely on A.I.-driven technologies in 2024 to make faster decisions with greater confidence and clarity.

From our work with retailers, we know more of them will streamline operations by using A.I. image recognition to digitally verify that each store executes shelf-sets, marketing materials, and merchandising plans according to corporate plans.

Beauty giant Sephora uses A.I. to personalize the customer experience

For example, A.I.-driven technologies like Optimum Retailing’s Automated Photo Compliance (APC) tool allows store teams to take a picture of a display or shelf set and then have the photo automatically checked for accuracy against plans.

Photos that the system determines are not compliant can be sent to head office for manual review.

Retailers save time with A.I. tools because they minimize the need for human effort on certain repetitive tasks.

For instance, without automated photo compliance technology, retail headquarters could manually review 10,000 merchandise displays across a national chain of stores to ensure accuracy and consistency.

However, with APC, headquarters might need to review only 200 displays flagged as outliers requiring human judgment.

Fashion retailers use generative A.I. to help store employees save time and access up-to-date information for better decision-making

4. Multisensory experiences will make more stores

irresistible

In 2024, more retailers will literally make room for in-store multisensory experiences that e-commerce

can’t match.

While consumers enjoy the convenience offered by e-commerce, they still love in-store experiences.

We keep visiting brick-and-mortar stores for unparalleled sensory experiences, social interaction, certainty of fit, easy returns, and immediate access to products.

When designed with care, value-added, multisensory experiences can attract more foot traffic to stores, boosting sales, goodwill, and loyalty.

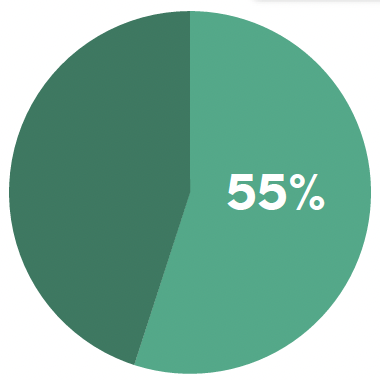

More than half (55%) of consumers said they shopped in physical stores that created engaging experiences.27

In response to consumer demand, 33% of retail professionals said their company is exploring experiential store formats.28

“Retailers need to

give consumers a

compelling reason

to visit their

physical stores or

they’ll just shop

online.”

-Sam Vise, CEO and Co-

Founder, Optimum Retailing

That’s why we believe more retailers will invest in new amenities like in-store coffee shops, nail bars, or on-site stylists to drive more traffic and delight shoppers with new experiences.

Retailers engage our senses with captivating experiences

Many retailers are already investing in immersive store experiences to attract shoppers back to physical stores with interactive and personalized interactions that build loyalty.29

Many retailers are already investing in immersive store experiences to attract shoppers back to physical stores with interactive and personalized interactions that build loyalty.29

The concept store’s associates are trained cosmetologists and licensed stylists who can enhance customers’ personal styling and teach them how to achieve the same results at home.30

To entice hungry customers and earn more of their meal dollars, U.S. supermarket chain Hy-Vee recently opened its biggest store to date, which features a large food hall.

For an aromatic escape, France-based Columbus Café & Co offers an authentic Parisian experience. The retailer is expanding its café concept across Canada through its partnership with leading bookstore chain Indigo Books to whisk customers away to the City of Light with tantalizing croissants and café au lait.32

Making room for exceptional store experiences

In 2024, retailers will look for new ways to optimize retail spaces, including the strategic use of store layouts.

Retailers have long used in-store camera systems to track where shoppers walk and dwell within each store. But knowing where shoppers like to stand isn’t the same as knowing where shoppers like to buy.

More advanced technologies, like Optimum Retailing’s retail intelligence platform, can go one step further, integrating into retail point-of-sale systems to generate “profit maps” that help identify the most (and least) profitable areas of a store.

Understanding the least productive areas of their stores from a sales and profitability perspective can help retailers find room for those new amenities intended to enhance customer experiences.

Repurposing “dead spaces” to enhance customer experiences and drive greater foot traffic? That’s a win-win for customers and retailers.

- Retailers will get personal with consumers and communities with

localization

To resonate with shoppers and earn their loyalty, more retailers will cater their offerings to local

communities by localizing the store experience.

Unlike using a standardized approach to all stores, localization efforts celebrate what’s unique about a store’s particular geographic area and people. These efforts can focus on factors like area demographics and sources of pride within the neighborhood.

As consumers increasingly migrate from large urban areas to the suburbs, they create new micro cities. Retailers have an opportunity to engage entirely new demographics of shoppers as communities evolve.

Due to ongoing population shifts, stores within the same chain often show variability in their locations, size, offerings, and target audiences, and these factors affect store operations.

Brick-and-mortar stores in a high-density metropolitan city are likely to have less square footage, limited assortments, and a more diverse range of pedestrian consumers.

By contrast, suburban stores are able to have larger footprints, broader assortments, and less diverse segments of consumers who overwhelmingly drive to these stores.

Localizing store promotions helps retailers differentiate their offerings by getting closer to consumers with tailored offerings.

Stores that use a localization strategy can boost their relevance and foster a sense of belonging within a particular geographic area. Effective localization strategies show that retailers strive to understand, respect, and resonate with consumers by reflecting their needs and everyday lives.

This approach can build relationships with consumers in the nearby community to earn their sales and loyalty. 33

Retailers show local love

Retailers localize their store offerings to appeal to a range of ethnicity, socioeconomic distinctions (such as upscale neighborhoods), and lifestyles like university campuses or retirement communities.

To celebrate the local scene, beauty brand Glossier matches its stores’ design elements to the city in which they are located. 34

Localization efforts are driving more business strategies to support sales growth in brick-and-mortar stores.

U.S. department store chain Kohl’s announced plans to use data science to speed up localization efforts across its entire store fleet through 2024.35

Target is redesigning its stores with plans to localize product offerings to better reflect the needs of community members. New design features will be rolled out at more than 130 stores, an effort that will extend into 2024.36

Localization efforts are driving more business strategies to support sales growth in brick-and-mortar stores.

U.S. department store chain Kohl’s announced plans to use data science to speed up localization efforts across its entire store fleet through 2024.35

Target is redesigning its stores with plans to localize product offerings to better reflect the needs of community members. New design features will be rolled out at more than 130 stores, an effort that will extend into 2024.36

For cultural resonance, Target and Kroger both use localization strategies that include curated assortments and targeted promotions to local Hispanic communities near certain stores. 37,38

It isn’t just traditional retail stores that seek differentiation through localization, as quick service restaurants also see the power of adapting to the needs of local customers.

McDonald’s spices up its menu with localization strategies to cater to local consumers in nearly 27,000 restaurants outside the U.S. Country-exclusive

offerings include India’s Maharaja Mac, Switzerland’s McRaclette, and Japan’s Roasted Soy Sauce Bacon Tomato Thick Beef. According to the Wall Street Journal, local menu items make up about 30% of McDonald’s food sales, proving it pays to go local. 39

Helping stores stand out and sell with localization

While e-commerce is very good at personalizing the online shopping experience, it has never been easier for brick-and-mortar retailers to also personalize and localize the in-store experience. New technology helps

retailers get much more specific in their efforts to adapt stores on a hyper-local level and resonate with consumers in the area.

Optimum Retailing’s work with retailers has shown that data profiling tools make it easy for teams to create tailored programs for each market and customer segment. Retailers can design and deliver campaigns and product launches with specific national, regional and local executions, quickly and at scale. By collecting in-store data and then applying retail intelligence tools to better understand customer needs, companies like OR can help retail teams increase relevance via localization that ultimately results in increased sales.

Technologies that enable personalization on a store-by-store or regional basis better serve the needs of local communities, leaving shoppers feeling valued, understood, and more willing to buy.

- Labor issues will force retailers to do more with less

Labor issues represent a major source of stress for retail executives.

Several metrics show why that’s totally understandable. Seven in 10 executives surveyed said labor was the number one challenge for 2023. 40

At the height of the 2022 holiday sales season, 879,000 retail jobs remained unfilled.41 Hiring and retaining employees remains an ongoing challenge, due to intense competition for hourly workers. 42

Reduced staffing puts pressure on store teams that need to do more with less. The labor shortage affects productivity, morale, and the in-store experience: if there are not enough staff members on the shop floor, customer service is noticeably compromised. 43

Why are retail workers scarce?

Shifting economic and consumption trends have led several prominent retailers to lay off workers and reduce hiring to keep costs down. Major retail

companies that recently announced layoffs include Amazon, CVS, David’s Bridal, H&M, and Walmart. 44

Retailers spanning diverse categories are reducing headcount to endure economic uncertainty. In the U.S., BestBuy is laying off hundreds of store workers because fewer shoppers are buying consumer electronics. 45

Gap Inc. announced it would lay off 1800 employees after cutting 500 corporate jobs in September 2022. 46 Meanwhile, Tesco, Britain’s biggest supermarket group, said its restructuring plans will impact around 1,750 workers. 47

Layoffs aren’t the only factor contributing to the current labor shortage in retail, as:

- Industry experts cite an increase in early retirements since the start of the pandemic.

- Many lower-wage workers have been able to move to new, higher-paying positions due to a strong labor market.

- Many retail workers have also left their jobs due to burnout, anxiety, or new priorities that arose during the pandemic.48

These market factors have led retailers to realize they need new ways to reorganize talent around value creation activities.49

How retailers are optimizing labor allocation to boost productivity

Fortunately, leveraging technologies can help retailers make the best use of their staff. For instance, Optimum

Retailing’s Level Of Effort feature enables head office decision makers to accurately understand the number

of labor hours needed for any given task – from resetting planograms and stocking shelves to merchandising activities like putting up marketing campaign posters and building displays – helping them better prioritize what tasks need to be done given the limited people resources available. Our clients see a 20-30% average reduction in non-selling hours by leveraging such insights.

In 2024, more retailers will invest in these innovative labor assistance solutions to set their retail teams up for success; staff will spend less time on non-essential tasks and more time delighting customers.

Navigate global retail trends with ease

In 2024, smart global retailers will prioritize investments that increase efficiencies and enhance shopper experiences.

These investments will include retail media programs, technologies that drive efficiencies, artificial intelligence capabilities,

multisensory experiences, localization efforts, and hyper-efficient store teams.These global retail trends are all driven by

the need to cut costs, drive growth, and continue to give people a reason to shop in-store by providing exceptional

experiences that e-commerce isn’t able to deliver.

Ask us how our retail intelligence platform can make your stores more successful.

Trusted technology solutions, including Optimum Retailing’s retail intelligence platform, can help retailers operate

stores more efficiently, more effectively, and more profitably.

And the result of these efforts will be an unbeatable competitive advantage for 2024 and beyond.

Sources

1.!Davey, James. Retail media ad revenue forecast to surpass TV by 2028. Reuters. June 12, 2023.

2.!Yuen, Meaghan. Mercado Libre, Tesco, and beyond: Retail media advertising is rising on a global scale. Insider Intelligence. June 30, 2023.

3.!Retailers Give In-Store Media an Interactive Twist to Boost Basket Size. PYMNTS. March 21, 2023.

4.!Lipsman, Andrew. In-Store Retail Media 2023. Insider Intelligence. October 13, 2023.

5.!Ibid.

6.!Ibid.

7.!Limmer, Dennis. Have You Heard About the Power of Retail Audio Advertising? RetailWire. November 9, 2023.

8.!Ibid.

9.!Berthiaume, Dan. Kroger turns coolers into digital ad space with ‘smart screens.’ Chain Store Age. May 24, 2023.

10.!Esposito, Alicia. Sainsbury’s Doubles Down on In-Store Retail Media. Retail TouchPoints. October 6, 2023.

11.!Reagan, Courtney. Nearly all Americans cut back on spending due to inflation, CNBC survey finds. CNBC. June 14, 2013.

12.!Horsley, Scott. These are some of the ways inflation is changing Americans’ spending habits. NPR. August 21, 2022.

13.!Ryan, Tom. Will Inflation Reshape Gen Z’s Spending Habits? RetailWire. October 18, 2023.

14.!Rider, Nicholas. Euromonitor reveals 2024 consumer trends. Retail World. November 17, 2023.

15.!2023 retail industry outlook. Deloitte. 2023.

16.!Walgreens Looks Aisle to Aisle to Cut Costs. PYMNTS. October 13, 2023.

17.!Gamble, Molly and Alan Condon. Walgreens to cut $1B in costs, close 60 VillageMD sites. Beckers Hospital Review. October 12, 2023.

18.!H&M shares jump 17% as summer collection boosts profit. CNBC. June 29, 2023.

19.!Retail Think Tank Whitepaper: Get ready for retail’s third wave of disruption. KPMG UK. July 2023.

20.!Here’s how artificial intelligence can benefit the retail sector. World Economic Forum. January 6, 2023.

21.!What is AI? McKinsey & Company. April 24, 2023.

22.!Reuter, Dominick. More than 2,800 stores are closing across the US in 2023. Here’s the full list. Business Insider. October 18, 2023.

23.!5 ways Sephora is innovating with technology. Retail Boss. October 13, 2023.

24.!GlobalData. Leading retail companies in the artificial intelligence theme. Retail Insight Network. March 15, 2023.

25.!Popov, Kosta. How retailers are embracing AI. Retail Customer Experience. July 11, 2023.

26.!McDowell, Maghan. How fashion is using generative AI in-house. Vogue Business. October 31, 2023.

27.!Euromonitor International Voice of the Consumer: Lifestyles Survey, fielded January/February 2023 (n=40,691).

28.!Euromonitor International Voice of the Industry: Retail Survey, fielded June/July 2023 (n=186).

29.!Jenkins, Maia. Sally Beauty Builds Out Immersive Experiences with New Concept Store. RIS News. April 5, 2023.

30.!Ibid.

31.!Douglas Moran, Catherine. Order up! How grocers are replicating the restaurant experience in retail. Grocery Dive. October 30, 2023.

32.!Toneguzzi, Mario. Columbus Café Partners with Indigo to Open In-Store Locations Across Ontario and Quebec [Interview]. Retail Insider. October 17, 2023.

33.!Monteros, Maria. Why the cookie-cutter store model will fall out of favor in 2023. Modern Retail. December 30, 2022.

34.!Monteros, Maria. ‘What’s old is what’s new again’: Why larger retailers are emulating the neighborhood store strategy. Modern Retail. September 29, 2022.

35.!Monteros, Maria. Why the cookie-cutter store model will fall out of favor in 2023. Modern Retail. December 30, 2022.

36.!Ibid.

37.!Hamstra, Mark. Kroger remodels Houston store with Hispanic focus. Supermarket News. September 19, 2023.

38.!Lalley, Heather. Inside Target’s push to target Latino consumers. Winsight Grocery Business. September, 27, 2022.

39.!Luna, Nancy. 10 McDonald’s menu items you can’t buy in the US – from Switzerland’s ‘McRaclette’ to Australia’s ‘Big Brekkie Burger.’ Business Insider. August 16,

2023.

40.!2023 retail industry outlook. Deloitte. 2023.

41.!Ibid.

42.!Ibid.

43.!Retail Think Tank Whitepaper: Get ready for retail’s third wave of disruption. KPMG UK. July 2023.

44.!Biron, Bethany, Madeline Berg, Lakshmi Varanasi, Jordan Hart, Samantha Delouya, Aaron McDade and Grace Mayer. Layoffs sparked by Citigroup’s overhaul

started this week. Here’s the full list of major US companies slashing staff this year. Business Insider. November 15, 2023.

45.!Repko, Melissa. Best Buy lays off hundreds of store employees as shopping trends shift. CNBC. April 14, 2023.

46.!Howland, Daphne. Gap lays off 1,800 employees amid major restructuring. Retail Dive. April 27, 2023.

47.!Tesco’s UK store management changes to impact 1,750 jobs. Reuters. January 31, 2023.

48.!Stern, Matthew. Why are more retail workers quitting their jobs? RetailWire. March 10, 2023.

49.!Cost Optimization Playbook. KPMG. 2021